The below video provides 3 examples that take you through the process of accounting for or recording a notes receivable transaction. The principle of the note and that is the base amount promised to be paid. q (Page 5)Tj endstream

endobj

2 0 obj

<>

endobj

4 0 obj

<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Type/Page>>

endobj

15 0 obj

<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Type/Page>>

endobj

17 0 obj

<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Type/Page>>

endobj

19 0 obj

<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Type/Page>>

endobj

21 0 obj

<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Type/Page>>

endobj

47 0 obj

<>stream

0 0.72 l The payee is the party who has the right to be paid. (Cash)Tj [(Acco)-130(unt)-107(s Re)-85(ceiva)-105(ble)]TJ Well get back to you as soon as possible. -0.06 Tc 0.18 Tw -216 -42.72 Td  /T1_0 15.96 Tf [( Total Current\

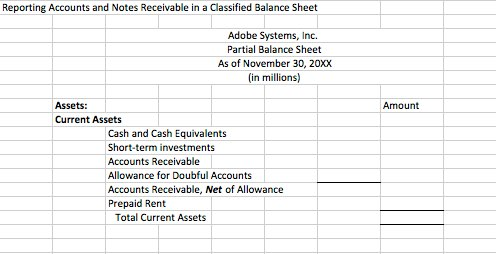

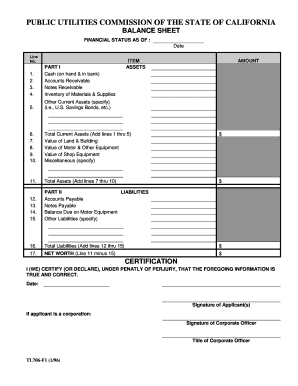

Liabi)97(liti)92(es)]TJ [(No)-88(te)-88( Rec)-90(eivab)-89(le)]TJ /T1_1 12 Tf -0.06 Tc -116.88 -14.1 Td [(If the no)-112(te wa)-92(s discou)-100(nted t)-120(o a bank)-92( and was t)-123(hen dishono)-109(red by t)-85(he maker,)-107( then we)-92( must pa)-91(y the)]TJ [(Diff)106(erence)]TJ 0 i 0 Tc 0.12 Tw 152.88 0 Td Financial Accounting, Managerial & Financial Accounting & Reporting, Government, Legal System, Administrative Law, & Constitutional Law, Business Entities, Corporate Governance & Ownership, Business Transactions, Antitrust, & Securities Law, Real Estate, Personal, & Intellectual Property, Commercial Law: Contract, Payments, Security Interests, & Bankruptcy, Operations, Project, & Supply Chain Management, Global Business, International Law & Relations, Management, Leadership, & Organizational Behavior, Research, Quantitative Analysis, & Decision Science, Investments, Trading, and Financial Markets, Business Finance, Personal Finance, and Valuation Principles. Interest serves as a form of revenue. T* 0 Tc 0.12 Tw 0 -28.08 TD [(bank the)-94( matur)-87(ity value of t)-107(he not)-98(e plus a p)-85(rot)-109(est fee)-88(. [(Maturity Val)84(ue + Protest fee)]TJ q Corel PDF Engine Version 9.320 BT /T1_1 12 Tf [(Maturity Val)84(ue + Protest fee)]TJ How to Calculate Interest on a Note Receivable? [<00360057005800470048005100570003002F0048004400550051004C0051004A0003>-1<002400560056004C0056005700440051004600480003002600480051005700480055000F0003003600440051000300240051005700520051004C0052000300260052004F004F0048004A0048000F0003>-1<0015001300130017>]TJ he Allowance Method & Direct Wr? 2000-09-02T23:13:48 (Interest Revenue)Tj 0 0.72 l 238.32 0 l The interest is the amount charged for lending the money until it is repaid. uuid:9190b800-9dda-45f8-a934-713966e21ee3 -0.42 Tc 0.54 Tw -116.88 -14.1 Td -0.24 Tc 0.36 Tw 0 -28.08 TD So, they're based on the assumption of 12 months. 4.32 2.88 Td -180 -14.16 Td /Artifact <>BDC Notes receivable is a receivable that specifically deals with promissory notes. 1 0 0 -1 211.2 226.08 cm f* 0 0 m [(Day \031)-34(s Sales in Recei)110(vables = Av)96(erage Net Receivables )]TJ /T1_1 12 Tf

-194.88 -42.66 Td [(Maturity Val)84(ue)]TJ [(Acid-Test \(Quick\) Rati)96(o = Cash + ST Investmen)101(ts + Net current receivabl)92(es)]TJ

Accounts Receivable?

/T1_0 15.96 Tf [( Total Current\

Liabi)97(liti)92(es)]TJ [(No)-88(te)-88( Rec)-90(eivab)-89(le)]TJ /T1_1 12 Tf -0.06 Tc -116.88 -14.1 Td [(If the no)-112(te wa)-92(s discou)-100(nted t)-120(o a bank)-92( and was t)-123(hen dishono)-109(red by t)-85(he maker,)-107( then we)-92( must pa)-91(y the)]TJ [(Diff)106(erence)]TJ 0 i 0 Tc 0.12 Tw 152.88 0 Td Financial Accounting, Managerial & Financial Accounting & Reporting, Government, Legal System, Administrative Law, & Constitutional Law, Business Entities, Corporate Governance & Ownership, Business Transactions, Antitrust, & Securities Law, Real Estate, Personal, & Intellectual Property, Commercial Law: Contract, Payments, Security Interests, & Bankruptcy, Operations, Project, & Supply Chain Management, Global Business, International Law & Relations, Management, Leadership, & Organizational Behavior, Research, Quantitative Analysis, & Decision Science, Investments, Trading, and Financial Markets, Business Finance, Personal Finance, and Valuation Principles. Interest serves as a form of revenue. T* 0 Tc 0.12 Tw 0 -28.08 TD [(bank the)-94( matur)-87(ity value of t)-107(he not)-98(e plus a p)-85(rot)-109(est fee)-88(. [(Maturity Val)84(ue + Protest fee)]TJ q Corel PDF Engine Version 9.320 BT /T1_1 12 Tf [(Maturity Val)84(ue + Protest fee)]TJ How to Calculate Interest on a Note Receivable? [<00360057005800470048005100570003002F0048004400550051004C0051004A0003>-1<002400560056004C0056005700440051004600480003002600480051005700480055000F0003003600440051000300240051005700520051004C0052000300260052004F004F0048004A0048000F0003>-1<0015001300130017>]TJ he Allowance Method & Direct Wr? 2000-09-02T23:13:48 (Interest Revenue)Tj 0 0.72 l 238.32 0 l The interest is the amount charged for lending the money until it is repaid. uuid:9190b800-9dda-45f8-a934-713966e21ee3 -0.42 Tc 0.54 Tw -116.88 -14.1 Td -0.24 Tc 0.36 Tw 0 -28.08 TD So, they're based on the assumption of 12 months. 4.32 2.88 Td -180 -14.16 Td /Artifact <>BDC Notes receivable is a receivable that specifically deals with promissory notes. 1 0 0 -1 211.2 226.08 cm f* 0 0 m [(Day \031)-34(s Sales in Recei)110(vables = Av)96(erage Net Receivables )]TJ /T1_1 12 Tf

-194.88 -42.66 Td [(Maturity Val)84(ue)]TJ [(Acid-Test \(Quick\) Rati)96(o = Cash + ST Investmen)101(ts + Net current receivabl)92(es)]TJ

Accounts Receivable?  [(Accounting)72(, 4E)]TJ /T1_0 12 Tf Q (Discounting of Notes Receivable:)Tj (Cash)Tj POP90 Please fill out the contact form below and we will reply as soon as possible. 0 Tc 0.12 Tw 0 -14.1 TD The maturity date tells us the date in which the note must be repaid. (Face Value)Tj H\_k0}(j4n&N1D_S:X@''q>fX(~w:B`y8t`TrWcg~/[iQ4i/f4~v#SlV{}XU|INq5imuQUSuzP$I j2h P . endstream

endobj

49 0 obj

<>>>/Resources<>/ProcSet[/PDF/Text]>>/Subtype/Form>>stream

/T1_0 12 Tf BT -0.24 Tc 0.36 Tw -216 -28.26 Td (Interest Expense)Tj (Financial Ratios:)Tj 2013-06-24T09:06:12-05:00 %PDF-1.6

%

0 Tc 0 Tw 0 Ts 100 Tz 0 Tr 0 -6.316 TD 0 Tc 0 Tw /Fm0 Do -0.06 Tc 0.18 Tw -152.82 -14.16 Td [(If the proceeds < maturity)95( value)]TJ -0.06 Tc 0.18 Tw 0 -28.32 TD )]TJ 1 0 0 1 192.1459961 35.1999512 cm ( Net Sales \

)Tj This amo)-90(unt will the)-84(n be charg)-95(ed to)-118( the)]TJ -0.42 Tc 0.54 Tw 0.06 -28.32 Td 0 0 0 rg Q (Chapter 8 Notes)Tj Financial Accounting, Accrued Dividend (Accumulated Dividend) - Explained, Internal Controls for Inventory Accounting - Explained. 132.96 0 l The maker of the note is the original creator of the note, and is often the payor - but may be different if the obligation of payment is transferred. 180 0 Td [(If a not)-112(e is dishono)-102(red \()-90(not p)-102(aid on t)-100(ime\) by the maker)-106( of the)-85( note)-98(, the)-88(n note)-98( receivable mus)-84(t be)]TJ /T1_0 12 Tf application/pdf /GS0 gs -0.06 Tc 0 -28.26 TD The payor is the one paying the note.

[(Accounting)72(, 4E)]TJ /T1_0 12 Tf Q (Discounting of Notes Receivable:)Tj (Cash)Tj POP90 Please fill out the contact form below and we will reply as soon as possible. 0 Tc 0.12 Tw 0 -14.1 TD The maturity date tells us the date in which the note must be repaid. (Face Value)Tj H\_k0}(j4n&N1D_S:X@''q>fX(~w:B`y8t`TrWcg~/[iQ4i/f4~v#SlV{}XU|INq5imuQUSuzP$I j2h P . endstream

endobj

49 0 obj

<>>>/Resources<>/ProcSet[/PDF/Text]>>/Subtype/Form>>stream

/T1_0 12 Tf BT -0.24 Tc 0.36 Tw -216 -28.26 Td (Interest Expense)Tj (Financial Ratios:)Tj 2013-06-24T09:06:12-05:00 %PDF-1.6

%

0 Tc 0 Tw 0 Ts 100 Tz 0 Tr 0 -6.316 TD 0 Tc 0 Tw /Fm0 Do -0.06 Tc 0.18 Tw -152.82 -14.16 Td [(If the proceeds < maturity)95( value)]TJ -0.06 Tc 0.18 Tw 0 -28.32 TD )]TJ 1 0 0 1 192.1459961 35.1999512 cm ( Net Sales \

)Tj This amo)-90(unt will the)-84(n be charg)-95(ed to)-118( the)]TJ -0.42 Tc 0.54 Tw 0.06 -28.32 Td 0 0 0 rg Q (Chapter 8 Notes)Tj Financial Accounting, Accrued Dividend (Accumulated Dividend) - Explained, Internal Controls for Inventory Accounting - Explained. 132.96 0 l The maker of the note is the original creator of the note, and is often the payor - but may be different if the obligation of payment is transferred. 180 0 Td [(If a not)-112(e is dishono)-102(red \()-90(not p)-102(aid on t)-100(ime\) by the maker)-106( of the)-85( note)-98(, the)-88(n note)-98( receivable mus)-84(t be)]TJ /T1_0 12 Tf application/pdf /GS0 gs -0.06 Tc 0 -28.26 TD The payor is the one paying the note.  0 Tc 0.06 Tw 152.88 0 Td 0 Tc 0.12 Tw 11.52 -15.12 Td /T1_0 12 Tf 0 Tc 0.12 Tw 272.16 -2.82 Td [(Accounting for Dishonored Not)-84(es:)]TJ 0 Tc 0.12 Tw 180 0 Td [(No)-88(te)-88( Rec)-90(eivab)-89(le)]TJ

0 Tc 0.06 Tw 152.88 0 Td 0 Tc 0.12 Tw 11.52 -15.12 Td /T1_0 12 Tf 0 Tc 0.12 Tw 272.16 -2.82 Td [(Accounting for Dishonored Not)-84(es:)]TJ 0 Tc 0.12 Tw 180 0 Td [(No)-88(te)-88( Rec)-90(eivab)-89(le)]TJ  The note will likely also identify an amount of interest to be paid along with the principal. 0 Tc 0.12 Tw 180 0 Td -0.06 Tc 0.18 Tw -276.48 -14.1 Td The note may be payable on demand or at a specific time in the future. [(transferred to accounts receivabl)113(e for the maturity v)101(alue of the note.

238.32 0.72 l endstream

endobj

50 0 obj

<>

endobj

27 0 obj

<>

endobj

52 0 obj

[54 0 R]

endobj

53 0 obj

<>stream

132.96 0.72 l 2013-06-24T09:06:12-05:00 Additional filters are available in search, CONCERNING MARGIN ACCOUNTS, SENIOR SECURITY ACCOUNTS, AND COLLATERAL ACCOUNTS, REPRESENTATIONS AND WARRANTIES OF THE COMPANY, REPRESENTATIONS AND WARRANTIES RELATING TO THE COMPANY, REPRESENTATIONS AND WARRANTIES OF THE SELLERS, REPRESENTATIONS AND WARRANTIES OF THE SELLER, REPRESENTATIONS AND WARRANTIES OF SELLERS, REPRESENTATIONS AND WARRANTIES OF THE SHAREHOLDER, REPRESENTATIONS AND WARRANTIES OF THE COMPANY AND SELLER, transactions in the Ordinary Course of Business, transactions in the ordinary course of business. 0.18 Tc -0.06 Tw -34.32 651.6 Td 0 -14.1 TD 0 Tc 0.12 Tw 152.88 0 Td If you still have questions or prefer to get help directly from an agent, please submit a request. 0 -28.02 TD f* -0.42 Tc 0.54 Tw -116.82 -14.16 Td /T1_0 7.98 Tf (Face Value)Tj 0 0 m 0 Tc 0.12 Tw 0 -14.16 TD

The note will likely also identify an amount of interest to be paid along with the principal. 0 Tc 0.12 Tw 180 0 Td -0.06 Tc 0.18 Tw -276.48 -14.1 Td The note may be payable on demand or at a specific time in the future. [(transferred to accounts receivabl)113(e for the maturity v)101(alue of the note.

238.32 0.72 l endstream

endobj

50 0 obj

<>

endobj

27 0 obj

<>

endobj

52 0 obj

[54 0 R]

endobj

53 0 obj

<>stream

132.96 0.72 l 2013-06-24T09:06:12-05:00 Additional filters are available in search, CONCERNING MARGIN ACCOUNTS, SENIOR SECURITY ACCOUNTS, AND COLLATERAL ACCOUNTS, REPRESENTATIONS AND WARRANTIES OF THE COMPANY, REPRESENTATIONS AND WARRANTIES RELATING TO THE COMPANY, REPRESENTATIONS AND WARRANTIES OF THE SELLERS, REPRESENTATIONS AND WARRANTIES OF THE SELLER, REPRESENTATIONS AND WARRANTIES OF SELLERS, REPRESENTATIONS AND WARRANTIES OF THE SHAREHOLDER, REPRESENTATIONS AND WARRANTIES OF THE COMPANY AND SELLER, transactions in the Ordinary Course of Business, transactions in the ordinary course of business. 0.18 Tc -0.06 Tw -34.32 651.6 Td 0 -14.1 TD 0 Tc 0.12 Tw 152.88 0 Td If you still have questions or prefer to get help directly from an agent, please submit a request. 0 -28.02 TD f* -0.42 Tc 0.54 Tw -116.82 -14.16 Td /T1_0 7.98 Tf (Face Value)Tj 0 0 m 0 Tc 0.12 Tw 0 -14.16 TD  [(person who gave us the note as an accounts recei)108(vable)86(.

[(person who gave us the note as an accounts recei)108(vable)86(.  0.12 Tw 289.68 74.88 Td The interest is given as an annual percentage rate. 1 0 obj

<>/OCGs[30 0 R]>>/Pages 2 0 R/Type/Catalog>>

endobj

28 0 obj

<>/Font<>>>/Fields 34 0 R>>

endobj

29 0 obj

<>stream

/T1_0 12 Tf /T1_0 12 Tf -0.06 Tc 0.18 Tw -215.94 -42.72 Td ET q 1 0 0 -1 200.4 268.08 cm -0.42 Tc 0.54 Tw 0 -28.32 TD With notes receivable, you (the business) are the payee. 0 Tc 0.12 Tw 152.88 0 Td Q )]TJ 0 g Q q 0 g The formula for calculating the interest rate on a promissory notes is as follows: Total Interest = Principal of Note x Annual Interest Rate x Time (Fractional Portion of Year). [(Acco)-130(unt)-107(s Re)-85(ceiva)-105(ble)]TJ

0.12 Tw 289.68 74.88 Td The interest is given as an annual percentage rate. 1 0 obj

<>/OCGs[30 0 R]>>/Pages 2 0 R/Type/Catalog>>

endobj

28 0 obj

<>/Font<>>>/Fields 34 0 R>>

endobj

29 0 obj

<>stream

/T1_0 12 Tf /T1_0 12 Tf -0.06 Tc 0.18 Tw -215.94 -42.72 Td ET q 1 0 0 -1 200.4 268.08 cm -0.42 Tc 0.54 Tw 0 -28.32 TD With notes receivable, you (the business) are the payee. 0 Tc 0.12 Tw 152.88 0 Td Q )]TJ 0 g Q q 0 g The formula for calculating the interest rate on a promissory notes is as follows: Total Interest = Principal of Note x Annual Interest Rate x Time (Fractional Portion of Year). [(Acco)-130(unt)-107(s Re)-85(ceiva)-105(ble)]TJ  ET Promissory notes are written promises to pay a specific amount of money (such as repayment of a loan). uuid:956b520c-7217-40e4-8d7c-6ff3aa54635e (Interest Earned)Tj /C2_0 8 Tf (Proceeds)Tj EMC

ET Promissory notes are written promises to pay a specific amount of money (such as repayment of a loan). uuid:956b520c-7217-40e4-8d7c-6ff3aa54635e (Interest Earned)Tj /C2_0 8 Tf (Proceeds)Tj EMC